In the second quarter of 2013, marketers maintained the momentum from the end of Q1. In AdExchanger’s Q2 mobile roundup, mobile ad networks and companies saw that rich media and in-app ads continued to drive expansion in the mobile RTB space.

In the second quarter of 2013, marketers maintained the momentum from the end of Q1. In AdExchanger’s Q2 mobile roundup, mobile ad networks and companies saw that rich media and in-app ads continued to drive expansion in the mobile RTB space.

Mobile ad exchange MoPub saw advertisers continuing to adopt programmatic buying at increasing rates. In the second quarter, the eCPM rate grew 25% from $0.76 to $1.01, while the eCPC rate increased 10% from $0.05 to $0.06, indicating a higher overall per-install price platform-wide.

June produced record highs in MoPub’s “bid depth,” which was up 80% to 1.5 average bids per auction, and its competitive factor (the average number of bids received for all auctions with a winning bid) increased 55% to 6.4 bids.

In terms of ad formats, clients continued to experiment with interstitial ads. “An interesting thing in Q2 was the growth of interstitials,” CEO Jim Payne noted. “We’ve noticed advertisers will use interstitials to show more of the game play experience and get users more engaged over the long term.”

The bid depth for interstitial ads increased 60% quarter over quarter and the eCPM cleared $2 in June for the first time. However, banners also saw a major boost with a 126% increase in bid depth Q/Q and a 50% increase in average price to $0.82 eCPM.

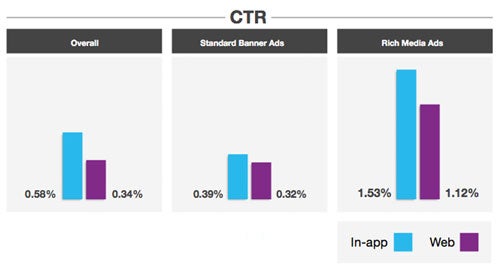

Looking at rich media ads, ads served within mobile applications performed better than those served on the mobile web, according to mobile ad network Opera Mediaworks.

Out of 378 mobile US ad campaigns that ran in May, users clicked on in-app ads 1.53% of the time, versus 1.12% for mobile web ads. Standard banner ads averaged a 0.39% click-through rate when served in-app and 0.32% when displayed on a mobile website.

The reason in-app ads were more successful, according to Opera Mediaworks CEO Mahi de Silva, is because “there’s so much more that you can present in an in-app context than what you can do on the mobile web,” he said. “It’s more difficult to do custom interactions on the mobile web whereas in-app ads allow for better rendering, more animations, better videos, etc.”

Taken together, overall in-app ads performed 1.7 times better than the mobile web, but they are still the minority, according to the firm. The number of ad campaigns and impressions on the mobile web versus in-app is nearly a 3:2 ratio.

In regards to operating systems, iOS continued to be the leader in both impression volume and revenue generation, capturing nearly 44% of all ad impressions and almost half of all revenue.

However, when comparing mobile phones using iOS and Android, the two systems were in a virtual tie for share of ad impressions, with just over 30% each. Late last year, Android inched ahead of iPhone with a slight lead (31% vs. 29%), but iPhone has been inching back and within one percentage point ever since.

The iPhone is still on top in terms of monetization, with 36.4% of revenue versus Android’s 27.8%. And while in Q1 Android tablets began appearing in Opera’s data set, their market share is still almost imperceptible, according to the company. Also, Accordant Media reported that 43% of all Q2 mobile RTB impressions came through tablet devices, compared to 57% from smartphones.

Mobile ad exchange Nexage recently reported that more than 50% of spend on the Nexage Exchange is now happening through real-time bidding (RTB). The RTB share of spend has grown from 13% to 50% in 18 months, with a 3x increase in RTB spend during the first half of 2013.

This result can be attributed to two reasons, explained Nexage CMO Victor Milligan. “We reached this goal because one, the market forces driving programmatic are significant and shared between sellers and buyers, and two, buyers are moving more spend to the Nexage Exchange in response to premium audience enriched with data.”