Retailers that push fewer posts, but better and more targeted ones, are gaining an edge over those that pursue volume when it comes to publishing Facebook content, new data suggests.

Retailers that push fewer posts, but better and more targeted ones, are gaining an edge over those that pursue volume when it comes to publishing Facebook content, new data suggests.

The 50 Social Retail Report from enterprise social media management company Expion analyzed 16,000 posts for the top 50 retail brands as designated by Interbrand. It found that as a whole, fan engagement and volume decreased for retail brands on Facebook, despite their increases in published posts – implying a need for more thoughtful earned and paid media strategies on the platform.

There appeared to be some breakdown in timing and communication, with 17% of retailers’ pushing their posts on a Friday, (perhaps in a drive to post before the weekend), despite the fact that more than 21% of the poorest performing posts occurred on this day of the week.

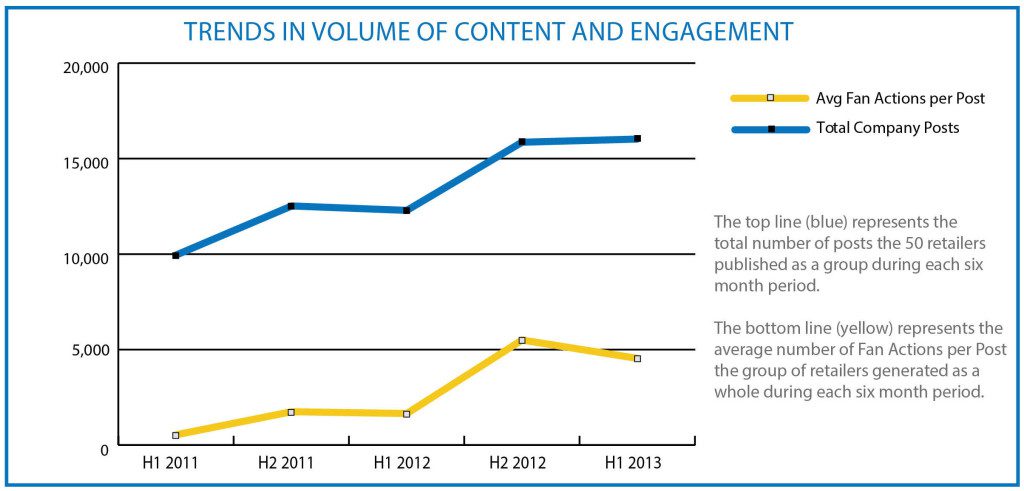

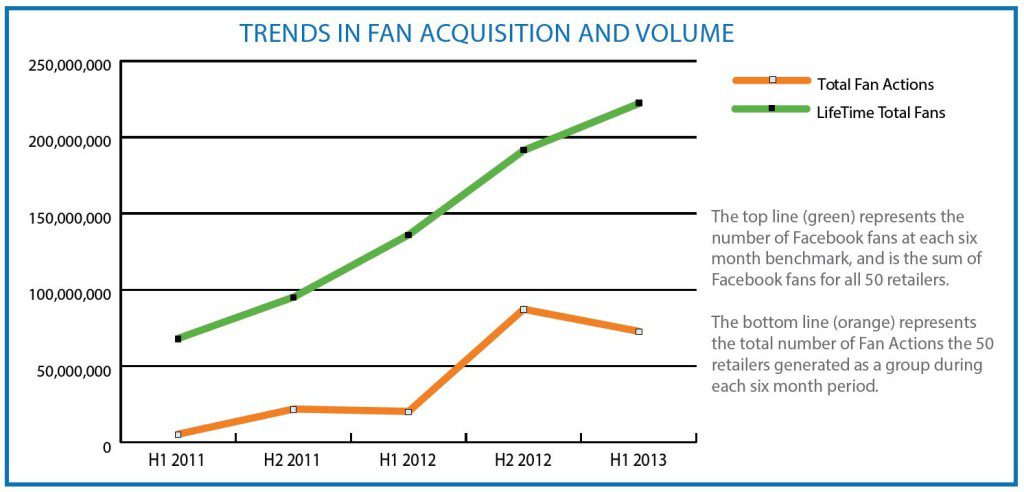

As Expion outlines, an increase in the number of retailers’ posts in 2011 and 2012 led to similar growth in engagement and volume metrics. But, in the first half of 2013, an increase in posts was met with a drop-off in engagement. Additionally, fan acquisition was the slowest it’s been since 2011.

“If you take a look at those trending charts, you kind of see the lifecycle of Facebook and social in general and we’re, really, in this third wave of social,” said Mike Heffring, CMO at Expion. “In the early stages, it was kind of, ‘What is this stuff?’ and then they immediately got in to building their fan base” and testing engagement strategies.

That escalated very quickly, he said, and in this latest period, while fan acquisition was still growing at a rate of 16%, it started to dip down and did not reach anywhere near the 40% growth rate retailers saw every six months between 2011 and 2012.

This third wave has brought on “massive amounts of posting that, combined with some ad support, I think we’re now at that peak where we have to go back and get in to this quality vs. quantity debate,” Heffring observed. “Analytically, it’s starting to look more at what really is working and to see each company almost as a social channel.”

If a company is putting out 300 or 400 posts over the course of six months, there will be a need for better organization, he said. For instance, retailers should block content into “new product posts” or “promotional posts” or posts for charity. If brands are complementing paid posts with organic posts, “they will have to be more mindful about what content they’re putting out and who they’re targeting.”

Among the retail brands that did best at fan engagement was Coach, which landed in the Top Five across engagement and volume rankings while also showing positive fan action growth. With a volume increase of 52%, part of Coach’s winning strategy was to post only two highly engaging posts per day on average, the report indicated.