“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is written by Archie Sharma, senior director of corporate strategy at OpenX.

To date, the subscription business model has been viewed by some as the gold standard in the over-the-top (OTT) and connected TV (CTV) space, but the advertising opportunity should make CTV companies think twice about what is right for them. As the space grows, they will need to implement the strategies that ensure sustainable long-term growth.

Content owners must consider several factors that influence how successfully they can monetize. Metrics such as consumer lifetime value, cost of acquisition, number of users and time spent consuming content per user can all have an impact. Understanding the weight that each of these metrics carries for any given business makes the decision that much more difficult when deciding between a subscription- or an advertising-supported revenue model.

While the subscription-based model has been a huge success for companies like Netflix, it is clear from conversations with content owners in the OTT space that, as the industry moves from innovation to expansion, the appeal of growing a subscription base has given way to experimentation with advertising. This is great news for marketers who are looking to find new avenues to engage with consumers where they’re spending more of their time.

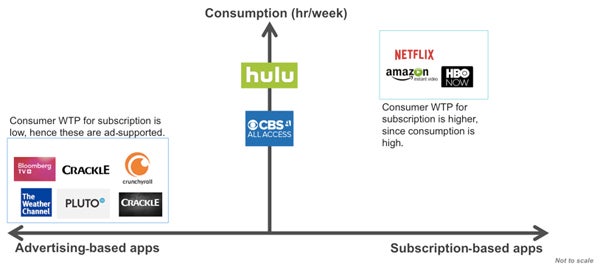

Figure 1: Content consumption framework – subscription vs. advertising (Source: OpenX). This is a representation of the OTT media landscape, showing media consumption and monetization models. It demonstrates consumer time spent versus the type of monetization model employed by each company.

Research shows that the most successful subscription-based content is composed of content aggregators like Netflix that bundle entertainment that’s both produced in-house and sourced from other networks and virtual multichannel video programming distributors.

On the flip side, the longer-tail distribution relies on ad-supported content with a lower average consumption rate per consumer in a given week. That’s because content available across these specific channels is much more limited, and thus consumers are not willing to pay for an ad-free experience. An average tail app where a consumer spends four hours a week can yield a publisher $5 on average per user per month in advertising revenue. This is based on the current $25 CPMs on connected TV.

With subscription fatigue, all signs point to advertising

Core to any subscription business is customer lifetime value, and balancing the ratio of customer lifetime value to cost of acquisition is tricky.

Many consumers are starting to sour on TV’s hard-bundled, high-cost subscriptions, and even with the advent of skinny bundles in OTT, many studies have found that consumers will only subscribe to so many content or streaming apps before feeling subscription fatigue. IBB consulting found that of consumers who subscribe to pay TV services and at least one OTT app, only 14% would be willing to pay more than $10 for an additional service.

To convince someone to subscribe to additional services, content has to be engaging enough to target a niche or mainstream audience such that they are willing to pay another subscription fee or drop their current OTT app. Businesses need the next “Game of Thrones” or “Stranger Things,” which is clearly easier said than done.

This is where advertising comes into play. An ad-based model provides the optimal option for publishers and content creators that have reached decent scale but may not yet have enough time spent per consumer or the one piece of killer content that will push them over the edge.

For content creators, CTV can deliver CPMs upward of $25, so advertising can be an attractive monetization strategy. For advertisers, this is a new avenue to reach audiences that can feed into a larger traditional TV and digital advertising strategy.

Although CTV advertising is still nascent, TV ad budgets will increasingly shift in this direction. Consumers’ preference for flexible viewing models means that traditional TV will continue to decline. With limited opportunities to earn a guaranteed spot in a consumer’s subscription pool, it’s safe to predict a bright future for advertising in OTT.

Further in the future, advertisers and publishers can expect advanced targeting, more efficient systems, greater standardization and transparency, as technology improves and more effective buying methods – like programmatic – can be applied to connected TV.

Follow OpenX (@OpenX) and AdExchanger (@adexchanger) on Twitter.