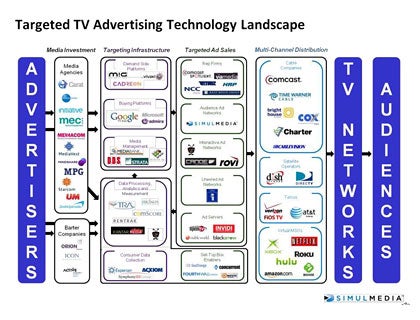

At last week’s AlwaysOn OnMedia event, former Tacoda CEO and current Simulmedia CEO Dave Morgan presented his take on the opportunity within ad technology and, unsurprisingly, it leads to the television business where Morgan’s current ad tech company is focused. In his presentation, he provides his own take on an ecosystem map for what he calls “Targeted TV.” View the prez and see below.

Morgan discussed the map and the targeted TV business with AdExchanger.com.

AdExchanger.com: With your “Targeted TV Advertising Technology Landscape,” you’ve entered the world made famous by LUMA Partners Terence Kawaja and his ecosystem map for display ad tech. What are some of the key differences between yours and his other than its for TV?

DM: As you can tell, our Targeted TV Advertising Technology Landscape is inspired by the one that Terry created for the Display Advertising Technology Landscape – in fact, he is going to help with ours and we’ll be co-branding it going forward. The striking thing is that the web ad tech and next-generation TV ad tech landscapes are quite similar. We think that the “Web-ification” of the TV industry will lead to an ad tech industry with a number of parallels to the one that developed for the PC web. However, it will have critical differences:

- It will be much bigger – TV advertising in the US is a $70 billion annual industry; display advertising in the US is only a $9 billion industry;

- It will be less crowded – today, the online display ad tech eco-system is crowded with thousands of companies; I doubt that we will ever see that happen in TV, since the TV industry is so much more concentrated around a limited number of very large networks and distributors; and finally,

- It will have more optimization upside – today, the online display market is already optimized by data and technology at probably a 90% level; TV ads, by contrast, are data and tech optimized at probably only a 10% level at best.

Why aren’t there more players in the targeted TV world given the size of the spend that you indicated is around $70 billion annually? Where are all the VC who like to invest, for example?

The enormous success of the web and web advertising over the past 10 years has distracted everyone. Very few folks have realized that, in spite of competition from the web, TV has continued to grow consistently in viewers, time spent viewing and ad revenue. The only ad tech start-ups in the space over the past 15 years have mostly been focused on creating set-top box level addressability, which has been a tough nut to crack. The long journey that those companies have taken has scared off a lot of investors. That leaves a lot of white space in the market today for companies like ours.

What’s the nearest approximation in the display advertising world to Simulmedia in terms of business models?

It would be easy to say that we’re building “TACODA for TV,” but it’s not that simple. We have created an Audience Sales Platform for TV, which is basically the audience ad network model from online, combined with sophisticated publisher yield management. Our job is to use data and technology to increase the revenue and yield that TV networks, programmers and system operators can generate from their “under-appreciated” inventory.

What can you say about the “data layer” in targeted TV? How does this compare to the first, second, third party data being used in PC-based display ads today? Where do you appending data for targeting going on TV?

The biggest difference between the data layer in TV and online is that in TV we rely much more heavily on predictive modeling and complex mathematical models to determine which ad to deliver, since we don’t have a true “cookie-equivalent” at the set-top box, nor do we have real-time dynamic ad delivery. In online, you can rely on simpler business rules to deliver ads because you have both. Fortunately, there is so much upside in the TV ad optimization space today that the lack of real-time dynamic targeting really doesn’t matter. The yield improvements that we have seen to this point in TV ads blow away anything I saw in online ads over the past 18 years. As real-time dynamic delivery and addressability enter the TV market at scale, which we expect to occur over the next five years, the optimization opportunities will probably increase even more.

Does attribution need to be solved in the targeted TV world? Who is going to do it and will it successfully link to other digital channels? Any thoughts on timetable?

Attribution doesn’t need to be solved on TV yet, but bringing better results attribution to the industry over time will certainly help it industry grow far beyond the $70 billion annually in advertising that it generates today. There aren’t many -if any – consumer marketing companies today whose sales would collapse if they stopped buying banner ads online. That is not the case with TV. Virtually all of the major consumer marketing companies in the US today would see their businesses crater if they stopped buying ads on TV. Fortunately, those ads can be made to perform even better, and yield more. As to who will create the new attribution linkages between TV advertising and sales, I really like the work that companies like Tivo, Kantar (WPP company), TRA Global, Marketshare Partners and Rentrak are doing in that space. I also expect that Nielsen will be a significant player here as well.

By John Ebbert