Growth, Of A Sort

2025 will be a year of growth for the advertising industry.

That’s the good news.

The bad news is it’s actually going to be paltry growth, merely in the single-digits. Gone are the growth rates of the past half-decade, when digital advertising was adding 10%-15% revenue per year practically hand over fist.

“I’m a realist … the exorbitant growth phases are behind us,” IAB Europe Chief Economist Daniel Knapp tells Digiday.

There has been an economic recovery, according to Knapp. But that’s “not translating into an acceleration of advertising growth in 2025.” Some European countries will probably have low single-digit growth next year, which he says would be the lowest rates since 2009.

Social advertising is an interesting case. A TikTok ban, which is fast approaching reality, would mean a large dispersion of ad budgets. It would be good for Snapchat, Instagram or YouTube, with viewers and advertisers up for grabs. But it would mean the entire pool of social advertising would lessen.

Brian Wieser, an industry analyst who writes the newsletter Madison and Wall, forecasts social advertising to grow by 5.4% in 2025, down from his 16.7% estimate for 2024 (excluding political advertising).

Conglomerating CPG

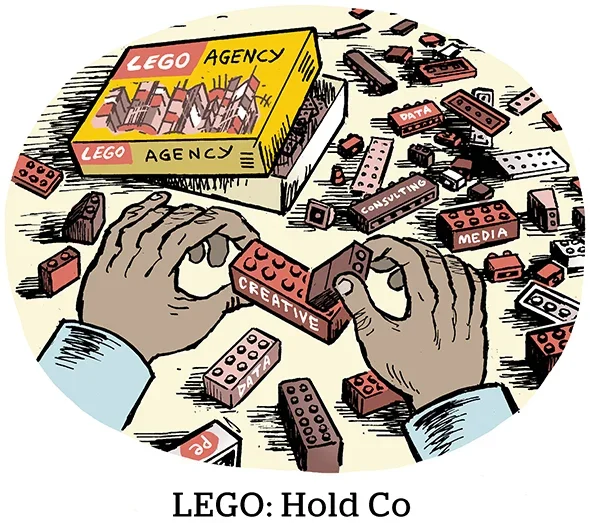

Agency holding companies continue to aggregate new services or simply merge together like Omnicom and Interpublic Group.

And the same trend is playing out among the largest consumer brand holding companies.

Bloomberg followed up the OMG and IPG news confirmation with its own report that Mondelez is considering a takeover of Hershey’s. Mondelez was rejected when it made a $23 billion bid for the iconic American candy company in 2016. This time, it might cost more than $45 billion.

In August, the CPG and candy giant Mars acquired the snack maker Kellanova (Pringles, Pop-Tarts, Cheez-Its and more) for $36 billion. Pepsi just took full ownership of Sabra, plus made a $1.2 billion deal for Siete, maker of grain-free chips.

About five to seven years ago, CPG holdcos were interested in acquiring DTC and startup brands to learn from their new business models and supposed first-party data preeminence. These new brand mega-mergers show a different approach, going back to retail basics like packaging innovation and in-store track records.

The data-driven DTC approach? Not so much. A year ago, Unilever came full circle by offloading one of the bellwether examples of the DTC acquisition trend, Dollar Shave Club, to a private equity buyer.

FTC’ing Is Believing

How might tech antitrust enforcement change under a second Donald Trump presidency?

A pitch by Republican-aligned FTC Commissioner Andrew Ferguson to take over as FTC chair suggests the commission’s priorities could soon diverge widely from those of current chair Lina Khan.

The pitch was obtained by Punchbowl News and posted on Bluesky by Consumer Reports’ Justin Brookman.

Ferguson proposes a pivot from in-the-weeds antitrust concerns like ad server adoption and programmatic bidding rules. Instead, he wants to crack down on platforms’ efforts to demonetize misinformation and support the ad industry’s brand safety guidelines.

Ferguson’s pitch says he would “focus antitrust enforcement” on “companies engaged in unlawful censorship.” And he seeks to “terminate all initiatives investigating so-called ‘disinformation’ [or] ‘hate speech.’”

The pitch also specifically promises to “investigate and prosecute collusion on DEI, ESG [and] advertiser boycotts” – a recent conservative hobbyhorse, as evidenced by Elon Musk’s lawsuit against GARM and Texas Attorney General Ken Paxton’s proposed investigation into the shuttered brand safety initiative.

But Wait! There’s More!

How one independent agency CEO views its advantage over holdcos. [Digiday]

OpenAI launches Sora, its text-to-video AI model. [The Verge]

Warner Bros. Discovery struggles to find a new ad sales chief. [Variety]

Senators Mike Lee and Peter Welch call on the FTC and DOJ to investigate DraftKings and FanDuel for alleged antitrust violations. [Awful Announcing]

Bluesky is working on a paid subscription model. [TechCrunch]

Reddit is experimenting with its own generative AI search chatbot. [TechCrunch]

Comcast gets the rights to bundle the Max streaming service in the US and UK. [The Information]

Texas AG Ken Paxton subpoenaed 404 Media for access to reporting materials related to an internal Google database of privacy violations. [404 Media]

China-based merchants are expanding beyond Amazon. [The Information]