Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Pubs Crawl

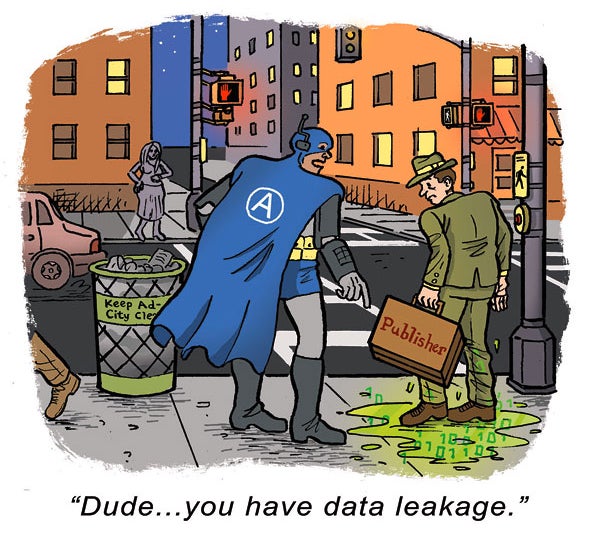

Publishers are more selective about ad tech vendors nowadays after suffering through incidents involving sequential liability, Digiday reports.

Publishers are more discerning about ad tech but don’t expect much to change following the MediaMath bankruptcy, like the Sizmek bankruptcy before that or the pandemic payment crisis when businesses halted all outgoing funds, even those legally owed to vendors.

Ad buyers won’t relinquish their advantages of sequential liability. Budgets sitting in their accounts for a few months might earn interest, for one, or be strategically hoarded and dispersed around earnings reports.

Digiday cites SSPs GumGum, Ogury and Index Exchange, which are forgoing repayment from publishers for their low seven-digit debts from MediaMath.

Magnite and PubMatic, which MediaMath owed in the low eight digits, are clawing back campaigns. But Magnite and PubMatic are public companies; shareholders won’t simply eat $12 million when there’s a legal right to the money. (Publishers have a moral right, whatever that means.)

Will Magnite or PubMatic suffer for it?

Probably not, says AdExchanger’s Anthony Vargas.

They’re the two biggest indie SSPs. Plus, publishers are used to getting the short end of the stick.

Show Me The Data

CTV advertisers are pressing for campaign data and transparency. They hope broadcasters are incentivized to disclose a little more about where CTV ads actually ran while advertisers are dialing up and down different CTV channels for testing, Adweek reports.

Now’s the time to set those annual spending floors. And what better way to do it than by offering content-level transparency?

Linear TV advertisers know the shows or movies where their ads were served. But that info is undisclosed in streaming media, partially as a competitive stance but also because CTV ads can be targeted at a personal or household level, and thus have fraught privacy restrictions.

But the name of a show and episode titles are now in about 10% of impression-based buys, up from zero last year, according to Joel Cox, co-founder and SVP of Strategus.

The result is a weird flip in terms of accountability because open programmatic bids can offer more data than direct-sold campaigns.

Biddable impressions “have a bit more accountability to them than direct deals at the moment,” one buyer tells Adweek.

Keep Your Eyeo On The Prize-o

Eyeo, owner of Adblock Plus and ad-block monetization service Blockthrough, among other ad-blocking and privacy software, wants to be more than the world’s largest ad blocker – and ad blocking profiteer.

Since early 2022, eyeo added Gertrud Kolb, a former director of engineering at Axel Springer, as CTO, and Google Marketing Platform’s former head of sales, Jan Wittek, as CRO. Oh, and eyeo CEO Frank Einecke joined from Google last year, too.

The latest is Vegard Johnsen, who was COO of spider.io, an ad fraud detection startup Google acquired in 2014. Most recently he was Google’s director of product management, and now he is eyeo’s new product chief.

Eyeo has tested all sorts of businesses since 2016, when it first expanded beyond ad blocking with the acquisition of Flattr, a web micropayment startup. Its DSP, Trestle, launched in 2021, and Blockthrough was acquired last November.

And eyeo has tried enterprise-level ad blocking and web security installations with schools and offices, which have massive numbers of people on the same Wi-Fi.

Johnsen joins the company this week with a “mandate” to expand the product portfolio.

Still, eyeo has the one cash cow – its ad-blocker whitelisting program – of which Google is the single biggest contributor.

But Wait, There’s More!

The media nonprofit Internews accuses Meta of ignoring and delaying responses when warned of potential violence using the platform. [The Verge]

Why ChatGPT is getting dumber at basic math. [WSJ]

Amazon guidebooks seemingly written by chatbot tech are the next great frontier for travel scammers. [NYT]

You’re Hired

Publicis Media recruits Veronica Appleton as SVP of DEI. [Campaign]