Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Live Shopping ROI … Or RIP?

Amazon, TikTok, Instagram and YouTube have all tried their darndest to make livestream shopping happen in the US.

But Americans just aren’t into it, Wired reports, and Chinese influencers and companies aren’t having much success exporting their successful businesses to America.

Live shopping and ecommerce in categories such as groceries and fashion have a strong value prop in China, because it’s a discovery channel for consumers to find new products. Americans, meanwhile, are happier to head to the store or a Walmart Supercenter.

Chinese consumers also spend hours online hunting for deals, whereas American consumers “value their time differently” and won’t stick around to save a buck, says Souffle Li, who recruits livestream sellers.

But there’s also an icky factor to contend with in the US. A Chinese livestreamer who sells women’s athletic apparel told Wired that she’s accustomed to her viewers being other women interested in clothes. In the US, though, she says it’s mostly 50- to 60-year-old men tuning in to watch women try on clothes.

Still, because livestream shopping works so well in China, it’s tempting to push the behavior in the US, according to one Silicon Valley VC who is receiving more and more offers from Chinese livestream shopping companies. “But on the other hand,” the VC says, “I am not so sure we can change American consumers’ behavior.”

Do The Math

TikTok says it has 150 million monthly active users in the US and earned $10 billion in revenue in 2022. But what’s the value of TikTok’s US business?

Eric Seufert of Mobile Dev Memo speculates on what the platform is worth and offers a peek into his back-of-the-napkin calculations.

Seufert starts by estimating US-only revenues for Meta and Snap and extrapolates from there to come to a ballpark estimate of TikTok’s US revenue at about half (between 44% and 59%) of the company’s overall $10 billion revenue.

Based on Seufert’s math, TikTok US generates between $4.4 billion and $5.9 billion, although he errs on the lower end of that spectrum since Snapchat is a closer corollary to TikTok’s user base and revenue per user.

Seufert doesn’t limit his noodling about TikTok’s revenue to ad spend. He also takes in-app purchases for coins into account. Consumers buy coins to tip creators and promote videos, a revenue stream that generated $100 million for TikTok on iOS devices in January alone.

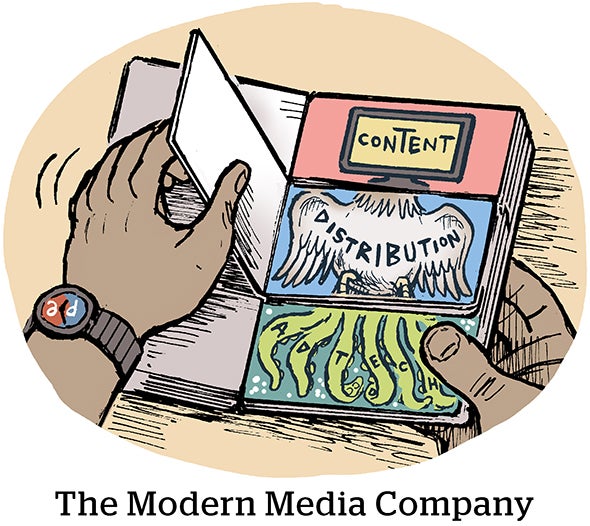

Misruption

Digital media disruptors are going the way of the dodo.

First-gen disruptors like BuzzFeed, Vice and HuffPost are going out with whimpers. The same goes for business news site Quartz, insider politics publisher Grid, tech news site Input and culture rag Gawker. Zap, zap, zap, zap.

“Successfully starting any new media operation is a near impossible needle to thread if you don’t have a very clear mission that distinguishes you from current offerings,” says Chris Geidner, a legal journalist who formerly wrote for Grid, to Vanity Fair. Geidner left to start a Substack.

Meanwhile Substack, another disruptor, is crowdfunding from its own writers because the investor market is ice cold.

Sam Parr started the business newsletter The Hustle and sold it to HubSpot for about $30 million in 2016. Parr announced his new venture this week, called Hampton, which is an invite-only membership (let’s call it what it is: a club) for business and media elite.

The main challenge is that the information resources and digital communities that would become the new crop of media disruptors no longer want to be “media” at all.

The New York Times, Washington Post and Wall Street Journal, meanwhile, have no true competition for their spots on the publisher podium.

But Wait, There’s More!

Substack is trying a new fundraising tactic: It’s inviting its newsletter writers to invest. [Axios]

Wearable brand devices will challenge our mental privacy. [Scientific American]

Microsoft Advertising introduces a third-party pilot program for government services that manage vital records, vehicle registration or recreational licenses, such as for hunting and beach parking. [MediaPost]

Wirecutter tests new content on different platforms to increase affiliate revenue. [Digiday]