Looking at the 2012 holiday shopping season, retailers with ecommerce websites deployed more marketing technologies, including social plug-ins, than in 2011, according to data gathered from Evidon and analyzed by kbs+ Ventures, the investing arm of kirshenbaum bond senecal + partners.

Looking at the 2012 holiday shopping season, retailers with ecommerce websites deployed more marketing technologies, including social plug-ins, than in 2011, according to data gathered from Evidon and analyzed by kbs+ Ventures, the investing arm of kirshenbaum bond senecal + partners.

Kbs+ Ventures analyzed 20 retail brands including Best Buy, Old Navy, Gilt, Piperlime, Gap, Disney, Target, Walmart, and Newegg. Of these retail sites, 75% used Google AdWords as an ad network, while 50% used Burst Media. However, there were 51% fewer advertising networks utilized overall by these retailers during the holiday season. Other popular ad networks included Acerno, Netseer, and 24/7 Media.

“While ad networks have not died, many have been weeded out,” said Darren Herman, chief digital media officer for The Media Kitchen and president of kbs+ Ventures, in an email with AdExchanger. “The surge of demand side platforms and trading desks are stealing the ad networks’ share. If they prove to add value…they will continue to steal share into 2013.”

When it came to the DSPs used, there was a 44% increase, from 9 different DSPs to 13 in 2012. Turn was used by 55% of retail sites, with Invite Media and MediaMath close behind, deployed by 50% and 40% of the sites analyzed, respectively.

In the site side optimization space, Omniture was most commonly used, by 75% of retail websites. The next most popular SSO technology, Monetate, was used by only 20%.

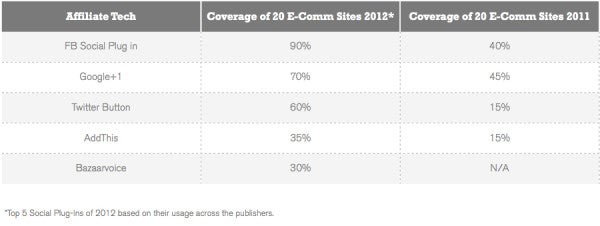

One interesting point was that, of the retailers analyzed, all of them had at least one social media plug-in on their site, compared to 45% who did in 2011. Walmart and Best Buy were the most social, and a Facebook plug-in was present on 90% of the sites analyzed.

Social media can help increase earned media, Herman noted, and while the earned media ecosystem is still growing, it has become more validated and is starting to mature in terms of measurement.

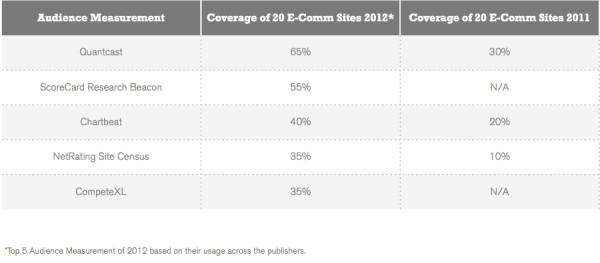

Audience measurement services also increased in usage, with Target and Newegg leveraging the most services, at 10 each. Quantcast was the most-used audience measurement tool, with 65% of retailers deploying the service, a 117 percentage-point increase from the 30% that used it in 2011.

All of this data comes after comScore reported that 2012 US online holiday spending reached $42.3 billion, a 14% increase over 2011. As more holiday spending moves online, these retailers are increasingly leveraging online advertising and social media to help them capture ecommerce dollars.

“It’s a golden opportunity for retailers, as in theory and in practice, marketing technologies help drive conversion which drive sales, which is what retail is all about,” Herman said. “The benefit is better consumer experiences, better conversion rates, and a more modern retail construct.”