Prime Time

Things aren’t going well for Hollywood.

There are the wildfires that rampaged through large parts of Los Angeles, of course. Widespread destruction has set back creative entertainment industry production.

That devastation comes on top of a string of bad years for Hollywood studios, which were hit hard by the pandemic and the 2023 writers’ and actors’ strikes, The New York Times reports.

But Amazon Prime is, well, a prime example of this same trend, but in another way. As The Information reports, Amazon has cut back deeply on creative production, having been burned by TV shows that went way over budget, costing Amazon billions.

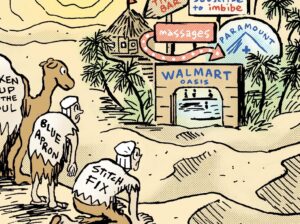

Now, Amazon is going big on sports and licensing content from would-be rivals like Disney+, Paramount+ and Apple TV+.

Rather than blocking other streamers from advertising on Amazon media – which is a common way to preserve primo ad inventory for one’s own shows – Amazon will produce less content and earn more by allowing other streamers to advertise their shows instead.

Disempaneled

Nielsen is finally ripping off the Band-Aid.

Panel-based ratings will no longer be available as a standalone measurement solution starting later this year, according to a memo viewed by The Wall Street Journal.

Panels aren’t going away, mind. Panel data will be part of Nielsen’s Big Data + Panel offering, which earned Media Rating Council accreditation last week. That product, which will be Nielsen’s endorsed currency during the upfronts this year, combines panels with data from set-top boxes and smart TVs.

But is it too late for Nielsen to win back advertisers and also broadcasters, which have been more than flirting with alternative measurement solutions recently? Video currency competitors Comscore, iSpot and VideoAmp have attracted buyers who want impression-based TV measurement.

But on the other hand, it’s quite expensive to maintain contracts with multiple currency providers. Rising costs is the main reason why Paramount let its contract with Nielsen lapse in October.

“Ending the ability to purchase the panel independent from other data signals is the end of an era,” says Jay Friedman, CEO of indie agency Goodway Group. “Even if that era is ending half a decade later than it needed to.”

Hide And DeepSeek

Another app from China is dominating the US app store charts, and this time it’s got nothing to do with TikTok.

A week ago, Chinese AI startup DeepSeek launched R1, a free open-source LLM that can reportedly match or surpass the performance of OpenAI’s o1.

Now, DeepSeek’s AI assistant, which uses R1, has supplanted OpenAI’s ChatGPT as the most-downloaded free app for iOS, CNBC reports.

Also, DeepSeek claims these breakthroughs were made at a fraction of the cost and computing power as other industry leaders. Its previous model, DeepSeek-V3, reportedly cost less than $6 million to train on 2,000 H800 Nvidia chips (which are less advanced than high-end chips due to export restrictions).

Meanwhile, OpenAI spent over $78 million to train its GPT-4 model. That might not sound like a lot compared to the company’s $80 billion valuation, but it’s 13 times what V3 cost and with the equivalent of 8,000 higher-performing H100 chips.

Not surprisingly, investors have been freaking out, and tech stocks plummeted on Monday. After all, if it’s possible to create superior open-source software with fewer resources, then what’s everybody investing billions of dollars to do elsewhere?

But Wait! There’s More

Streamers are focused on working well with others. [Marketing Brew]

Paramount tested live shoppable ads during the NFL playoff broadcast over the weekend. [Adweek]

How cloud tech is helping Levi’s ride new fashion and shopping trends. [WSJ]

Here’s how YouTube’s recommendation engine works in 2025. [Search Engine Journal]

You’re Hired

Rene Alegria joins Hispanic-focused radio broadcaster Nueva Network as chief innovation officer. [Radio Ink]