Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

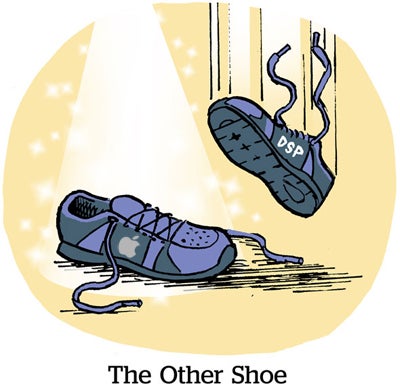

Has Apple Fallen Far From The Tree?

Apple is quietly pitching major agencies on ad opportunities for its Apple TV original content, Digiday reports.

Rumors have swirled for the past year that Apple is taking semi-tentative steps to develop its own DSP and launch its own search product (rather than shelling out billions to Google). The potential CTV inventory from Apple’s original content would ostensibly plug into the DSP.

But without a solid commitment from Apple, media execs are less than confident that it can and will stand up a legit DSP and CTV operation. Remember iAd or when Apple hired and then hastily reneged on a job offer to Antonio Garcia Martinez, an early developer of the Facebook Audience Network?

Despite previously unsuccessful attempts, however, Apple has become a massive advertising company and is becoming more at home with that fact.

Still, Ronan Shields reports that Apple is pitching an API-based platform akin to Google or Microsoft search – but without the important data-driven elements.

“Their view, which they clearly articulated, is they don’t believe in clean rooms,” says one agency exec, “[and] they don’t believe in any use of data.” Okay then.

Common Enemies Make Good Friends

Meta and Microsoft announced a major strategic partnership tied to the Meta VR platform. The tie-up is specifically to support business-related use cases for products, such as Microsoft Teams.

It’s a very good deal for Microsoft, writes Ben Thompson at Stratechery (who snagged a coveted joint interview with Microsoft CEO Satya Nadella and Meta’s Mark Zuckerberg). Although Microsoft doesn’t have its own VR play, it will be able to extract value from Meta’s investments in VR. This partnership will also speed up Microsoft’s role as an anchor tenant in Meta’s VR gaming category. (Gaming and business tools, like live meetings, are the two main early use cases for VR).

It’s also a good strategic deal for Meta, though, primarily because Meta needs help establishing a viable VR universe in which the company isn’t beholden to Apple iOS. But success here is far from a given.

As Thompson points out, “social media on your computer or phone isn’t like this: One of the reasons why an ad model is so compatible with social media is because it enables the service to be free, which makes it much more plausible that your friends are on the platform.”

And therefore, Thompson argues, “introducing even the slightest barrier to entry – much less a several hundred dollar one – makes it much less likely that a multiplayer experience is even possible.”

Quantity Over Quality

Data privacy legislation and especially Apple’s data policy changes have hobbled ad-supported platforms.

So how have major players like Meta and Google reacted to revenue shortfalls this year? By increasing their ad load, of course.

And it may be inevitable that other platforms will follow suit, writes Eric Seufert at Mobile Dev Memo.

Last week, Meta announced two new ad placements for Instagram, and YouTube, which is owned by Alphabet, is rolling out expanded ad pods for CTV that contain as many as 10 ads per break.

Generally, Seufert writes, ad platforms have pursued four strategies in response to this year’s “Mobile Marketing Winter”: increase ad load, increase reach, increase ad ROI and/or increase time spent on the site or in app.

Increasing the average time spent by users is difficult (who isn’t trying to do that?) – and practically impossible when platforms like TikTok are eating up attention share. There are data partners that can help improve ROI and media partners that supply net-new users, but they’ll cost you.

Increasing ad load can feel like the only viable option.

But Wait, There’s More!

Zoetop, parent company of fast fashion brand Shein, was hit with a $1.9 million fine by NY Attorney General Letitia James over data protection failures prior to a breach. [release]

How CMOs are thinking about new privacy restrictions. [Marketing Brew]

Gaming and entertainment publisher IGN acquires the agency 1TwentyFour. [MediaPost]

Valtech acquires digital marketing agency Union. [release]

WhatsApp got called out by an industry watchdog for implying in its advertising that wireless carriers are careless and that they read people’s personal text messages. [release]

You’re Hired!

OpenX hires Mike Chowla from PubMatic as its SVP of product. [release]