A new report from Interpublic Group’s MAGNA Global media research and buying arm reinforces earlier predictions that consumer packaged goods (CPG) brands would invest as much as $7 billion in digital advertising by 2018.

A new report from Interpublic Group’s MAGNA Global media research and buying arm reinforces earlier predictions that consumer packaged goods (CPG) brands would invest as much as $7 billion in digital advertising by 2018.

According to MAGNA’s 2015 Global Advertising Revenue Forecast, released Monday, verticals like CPG and pharmaceuticals, which once invested more heavily in traditional channels such as TV and shopper marketing, are increasing digital’s share of their overall media mixes.

“Large mainstream brands,” as the MAGNA report described it, historically lagged in digital ad investments, but have begun to move past the exploration stage “due to the availability of new solutions allowing marketers and agencies to manage and monitor digital spending” in a more precise and transparent manner.

These tools include attribution and reporting, brand safety and advanced audience targeting tools, according to Vincent Letang, director of global forecasting for MAGNA Global.

Brands’ use of data to improve campaigns has catalyzed digital as a complement to, rather than replacement for, larger branding campaigns. Thus, more brands are buying on impressions (CPM) vs. clicks (CPC) or more performance-based pricing, contributing to the $21 billion allocated toward data-automated transactions this year.

“The new opportunities created by programmatic buying have contributed to make digital media more attractive to large advertisers blessed with large client databases [who are] interested in multiple targeting tactics,” the report indicated.

Kimberly-Clark and snack foods company Mondelez International, for instance, are directly involved in their own media-buying strategies, from the standpoint of vendor selection and building an in-house programmatic capability.

But growing interest in digital and programmatic from the CPG camp does not indicate a mass exodus away from television (at least not yet). As the numbers stand, television commands close to 40% of global ad revenue in the US to digital’s 27.7% in 2014, although that’s changing too. In some geographic markets, digital has already outpaced TV ad spend, including in the UK, Australia, Germany and China.

And television ad revenue growth may be softening. Overall TV ad revenue growth was up 4.8%, well below MAGNA Global’s spring 2014 growth estimates of 8.6%.

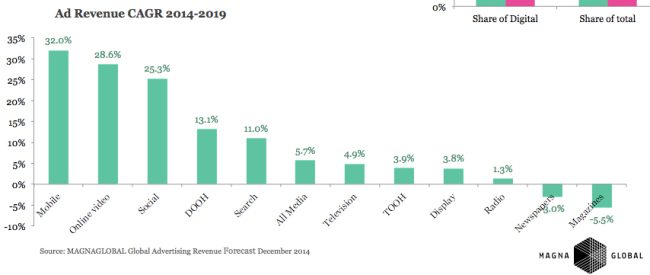

By 2019, MAGNA Global has predicted digital media will be neck and neck with TV, when both account for about 38% of global ad revenues. Earlier estimations forecasted digital to surpass TV ad spend as early as 2017.

“TV is the leading branding medium and digital has gotten so big that any further growth in digital spend has to be partly fueled by budgets shifted away from TV,” added Letang. “Most of that goes into video in the first stage, which is now a natural alternative/complement to many TV campaigns.”

In terms of what channels and formats in digital will characterize this growth, in 2014 social experienced the greatest uptick, up 64.8% in spend this year, followed by digital video, which grew 27.8%.

Global ad revenue is expected to increase 4.8% in 2015 to total $536.6 billion, which matched previous top-line growth estimates of 4.9% in the ad market globally.

According to similar estimates in ZenithOptimedia’s Advertising Expenditure Forecast, issued Monday, global ad revenue will reach $549 billion next year. One of the single biggest growth drivers in global ad spend is mobile, which will account for 51% of new ad dollars by 2017. Despite the obvious challenges of translating display and banner ad formats to mobile, social platforms Facebook and Twitter have done well with mobile and could capture 33% of spend there, this year, according to ZenithOptimedia.

Finally, GroupM also released its global ad report Monday, projecting 3.9% increase in global ad spend to $513 billion next year. This is a downward revision from the agency’s midyear forecast. In a prepared statement, GroupM North America Chief Investment Officer Rino Scanzoni said this is due to deceleration in TV spend since linear TV audiences will decline and because 2015 doesn’t have major global events like the 2014 Sochi Olympics.

2014 ad spend in the US increased 3.1% to $170 billion. Seventeen percent of that figure is digital.

Investment in digital advertising continues its steady increase worldwide, constituting 24.7% of global ad budget in 2014. In 2015, GroupM predicts digital will make up 27.6% of global ad budget. GroupM noted digital tends to grow two percentage points of ad budget share every year. By contrast, print loses ad share at a similar rate.

GroupM also saw hints, for the first time, that traditional TV share might be taking a hit. Between 2010-204, it was 43% of ad share and is expected to drop to 41.8% in 2015. This might be skewed by China’s swift move into digital, however, and the report emphasized it’s too soon to say whether this decline is a trend or an anomaly.

Story updated with comment from MAGNA and findings from Zenith and GroupM.