Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Hammer Time

Infillion is emerging as the top bidder in the bankruptcy auction for MediaMath’s assets, which include its demand-side and data management platforms, Insider reports. Sources say Infillion is making a bid of around $22 million.

That’s a steal for a company once valued at $1 billion. And it doesn’t even come close to the $125 million in unfulfilled payments owed to sell-side platforms such as Magnite and PubMatic.

One source tells Insider that Infillion “intends to restore [MediaMath’s] technology and recruit back former MediaMath staffers and clients.”

Over 300 employees lost their jobs when MediaMath filed for bankruptcy nearly two months ago. But many staffers may have moved on by now, and it’s likely that clients have, too – especially after clawing back revenue paid to publishers for MediaMath deals that left the SSPs uncompensated.

It’ll be quite the mess to clean up.

There are other bidders besides Infillion. Surprisingly, MediaMath’s founder Joe Zawadzki doesn’t appear to be one of them, despite his efforts to form a syndicate, Project Phoenix, to buy back the company’s assets.

The auction is set to take place on Wednesday morning.

Razzle Dazzle ’Em

Meta is doling out ad credits ranging from $40,000 to $200,000 to advertisers in an attempt to lure ad dollars back to the platform, Ad Age reports.

Media buyers are receiving “coupons,” as Meta dubs them, for three-day ad flights that aim for max reach across Meta’s video services (In Stream, Reels and Stories).

Meta’s also wooing advertisers with credits for its Instagram shopping ads, which it’s trying to drum up ad revenue around.

Users can click on the shopping ads to make in-app purchases, which allows Meta to gather coveted user data and keep tabs on customer behavior inside the app. By directing advertisers and users to shopping ads, Meta can recoup signal loss wrought by Apple’s privacy changes and allay advertiser concerns about accurate measurement and attribution.

Signal loss-wise, the social media juggernaut has been leaning into conversion APIs, which work with Meta’s data and tech to measure campaign results.

And it’s not the only one. Other walled gardens like TikTok, Pinterest and Snap have also created conversion APIs.

Grabbing The Headlines

X is rolling out another baffling change that will likely add to publishers’ and advertisers’ doubts about the platform.

Article links shared on X will no longer feature headlines or descriptions, Fortune reports. Instead, only the story’s featured image will be shown by default.

Previously, article links would include the featured image, headline and a short description of the article within a card. The text in the card did not count toward the post’s character limit, allowing reporters and news outlets to share content while also adding their own commentary.

With the card feature removed, users will have to spend their limited characters describing what the article is about or settle for posting only an image. The move could drive X Premium subscriptions, which allow 25,000 characters per post.

X ran the change by advertisers, who are reportedly less than enthused by the idea of running ads against contextless images. The decision seems to have been made by Elon Musk mainly because he didn’t like how much space article cards took up in the feed. Musk took credit for the change, saying it “will greatly improve the esthetics.”

But social platforms thrive on engagement, and headlines would often drive discussion on Twitter. So much for that!

But Wait, There’s More!

TikTok is serving up ads in search results. [The Verge]

Meta releases a desktop version of Threads amid steep user declines and stagnating engagement. [Washington Post]

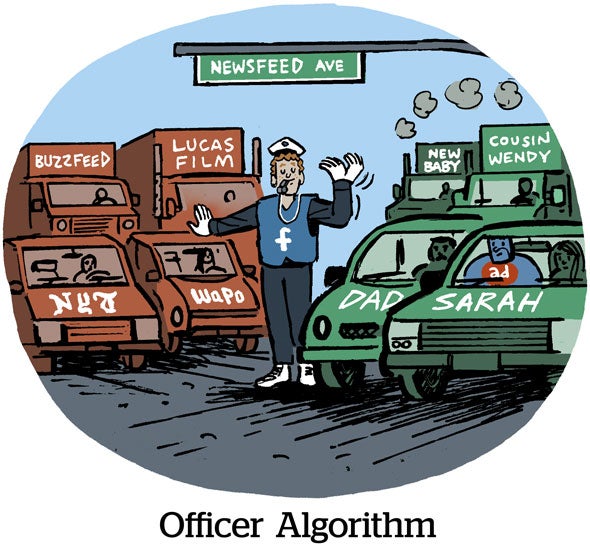

To comply with the EU’s Digital Services Act, Meta announces European users can opt out of Facebook and Instagram’s algorithmic feeds. [9to5Mac]

IBM sells Weather.com and its other The Weather Company assets to investment firm Francisco Partners. [Wall Street Journal]

In the wake of Vice Media’s bankruptcy, former Motherboard reporters launch employee-owned publication 404 Media. [NYT]

Media and tech execs debut research group aimed at supporting news publishers by influencing internet policy. [Axios]

In a bid for CMA approval of its Activision Blizzard acquisition, Microsoft will sell cloud gaming rights for Activision Blizzard titles to Ubisoft. [The Verge]

You’re Hired!

Nestlé Health Science appoints Brian Groves as CMO and Gabriella Viljoen as VP of ecommerce. [release]